Yield Emissions

The tokenomics includes a large tranche that is reserved for platform rewards in the form of various emissions, such as Yield Farming and trading bonuses.

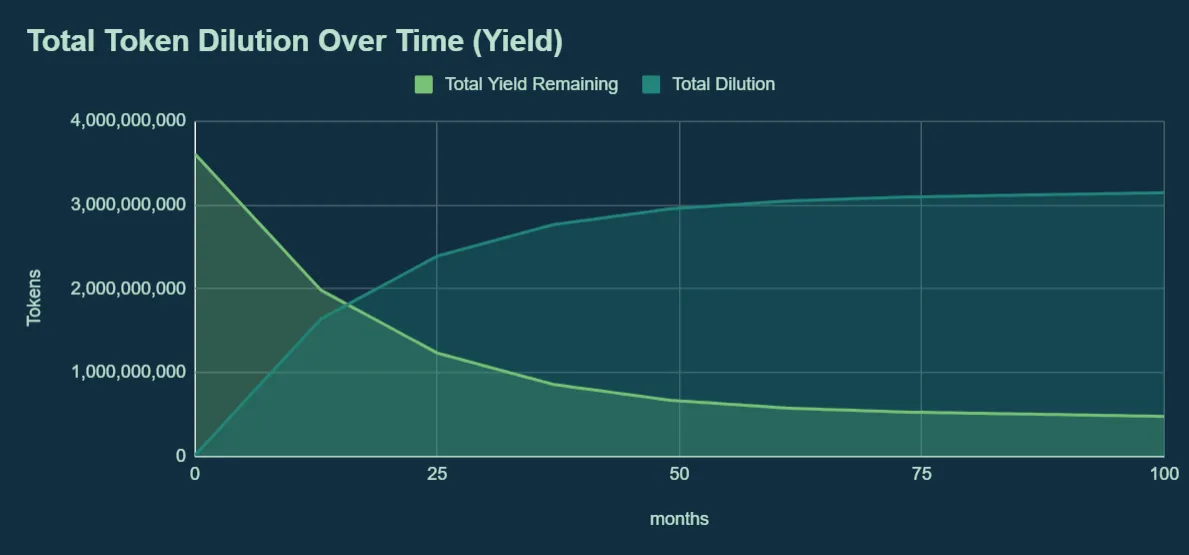

The yield emission exists to encourage users to provide liquidity to the platform. Liquidity is one of the most important key performance indicators (KPIs) for a new DEX. The yield farm emission will halve every year, for the first 6 years. After that there will be an ongoing tail emission for several years following to ensure the long term sustainability of the protocol.

The yield emission can be adjusted up or down by 25% on any given emission period, thus allowing the platform to provide more yield when needed to encourage users to add liquidity or to offer trading bonuses so more people use the platform. When a lot of liquidity is available and less yield is necessary, the yield can be adjusted downwards to reduce dilution.

Total average yield emission over time is expressed in the following chart.

The exact numbers will be worked out through data collected in the adjustment phase and an algorithm will then adjust the emissions automatically to meet the growth targets.

Phase 1: Bootstrap Phase

In this phase, token emissions will be set unsustainably high to encourage the community to provide liquidity and trade frequently. The success of this round will be measured with a target TVL and Daily Volume across trading pairs.

Phase 2: Adjustment

Emissions will be adjusted for a period of time to find a balance where inflation is minimized while but with some level of growth remaining in TVL and volume. If rewards are reduced too greatly, liquidity providers will remove their liquidity from the platform and go elsewhere to earn higher yield. If rewards are too high, inflation will slowly erode TEDY value.

During the emission adjustment period, TVL will be monitored, but trading volume will be the focus. Without trading volume, the platform won't be sustainable as reward emissions are reduced. If liquidity providers don't receive enough in trading fees from high trading volume, they won't continue to provide liquidity to the platform. Some of the emission will be used to provide incentives that encourage trading, thus increasing volume, and the fee structure will be adjusted and monitored.

Phase 3: Sustainability Phase

Based on the data collected in the previous two phases, an algorithm will be implemented to automate a period of sustainability. Volume and TVL will continued to be targeted with the various emission mechanisms that are the most productive. There will be a percentage of emission set aside for experimentation and manual giveaways, as voted on by the DAO.